Case Study: Talon Innovations

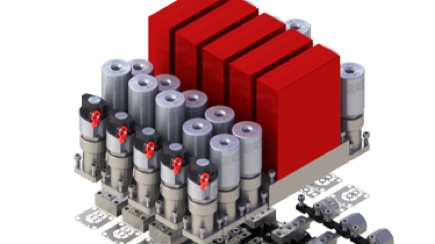

Talon manufactures high-precision machined parts primarily for the semiconductor industry and other buyers with stringent technical requirements. It has particular expertise in gas and fluid delivery systems, which are crucial to semiconductor manufacturing. The company is vertically integrated to provide design, machining, welding and assembly. Over the course of Graycliff’s ownership, the company’s EBITDA grew 10x on an organic basis. We exited our investment when the company sold to Ichor Systems in 2017.

Headquarters

Sauk Rapids, MN

Industry

Industrials

Exit Date

December 2017

Transaction Dynamics

Talon was a family-owned business that was looking for a buyer after the tragic loss of its founder. In addition to operating in an industry with relentless EBITDA pressure, the company’s revenues were highly concentrated in one customer. Graycliff saw the buyout as an attractive opportunity given the trends in semiconductors paired with Talon’s valuation and highly motivated sellers. We also recognized excellent leadership in its CEO and supported his vision for a turnaround.

Investment Thesis

Leading niche manufacturer with a highly sticky customer base

Talented leadership with a solid turnaround plan and further support from a Graycliff operating partner

Positive long-term macro industry trends as a tailwind

Entry at an attractive multiple, at the perceived bottom of the semiconductor cycle

Graycliff Value Enhancement

Helped Talon to develop and execute on a 5-year plan

Provided capital to support capacity expansion, including the add-on acquisition of Vulcan Machine, which also diversified Talon’s end-markets and customer base

Built out a world-class management team, including a CFO and VP of Sales

Helped the company to establish a Korea presence to better serve customers

Leveraged Graycliff’s operating partner to strengthen customer relationships and provide strategic guidance

“We leveraged each other’s strengths. They let us run the company with our expertise, and we leveraged their banking relationships, financial acumen, and ability to connect me with other CEOs at their other portfolio companies for best practices discussions.”